We have been hearing so many bad news as we start the year, with new wars emerging, and the US hitting every country around the world with tariffs - it seems like we can never catch a break.

But in the midst of all that chaos, we see news like the recent launch of LyndenWoods which did exceptional - sold 94% of its units in a day!

And also the recent land bid at Chuan Grove which drew 7 bids. This tells us that the developers are very confident with the market as not only were there many bidders, but the price at $1,376 psf ppr is also relatively high.

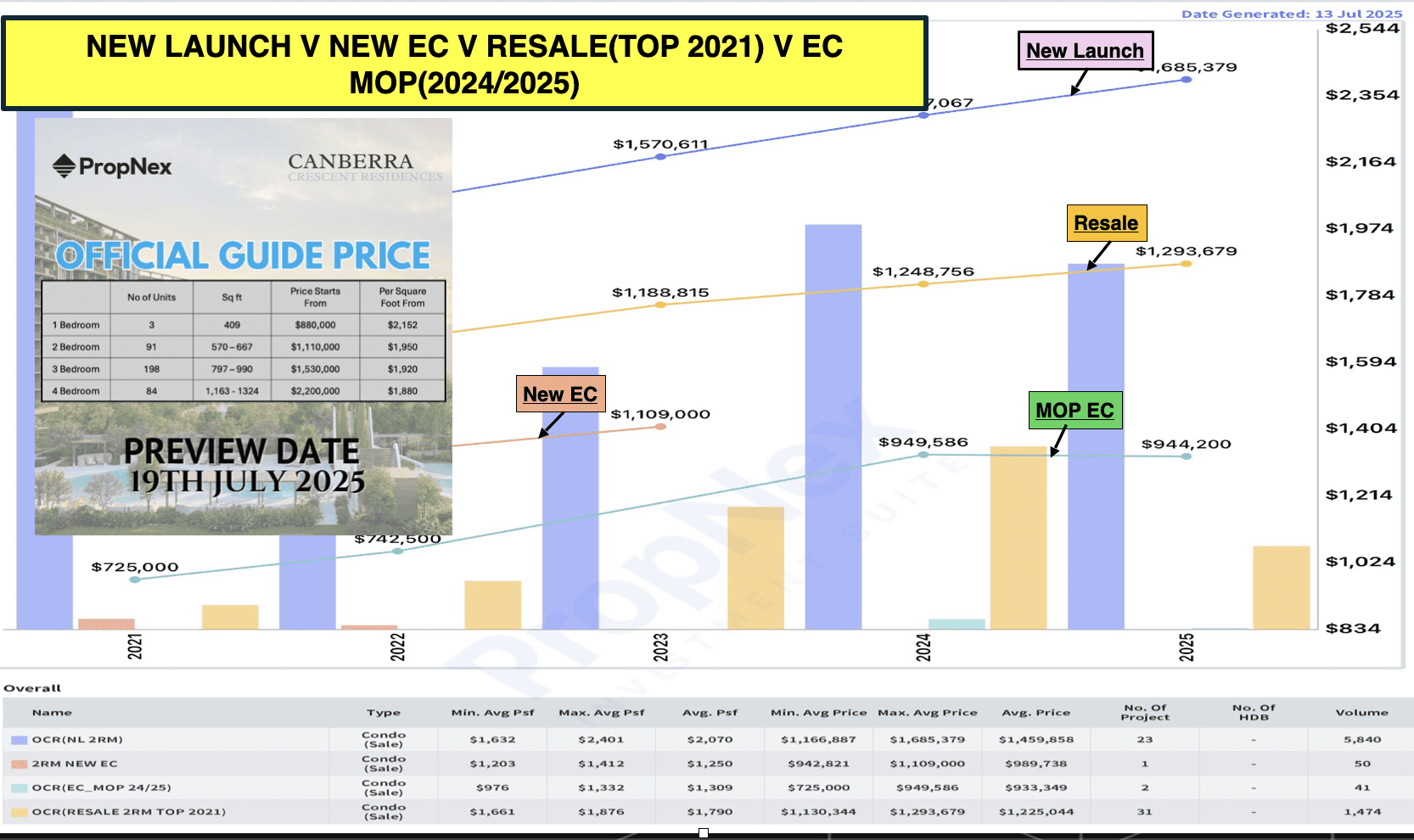

As you can see, prices of 2-bedrooms at Canberra Crescent Residences starts from $1,100,000 . And we compare it to the OCR market, we see new launch prices coming in at an average of $1,685,379, with resale going at $1,293,679, and even a brand-new EC sells at $1,109,000.

Buying an EC would actually cost you about $10,000 more. Would you choose an EC or a fully privatised condo?

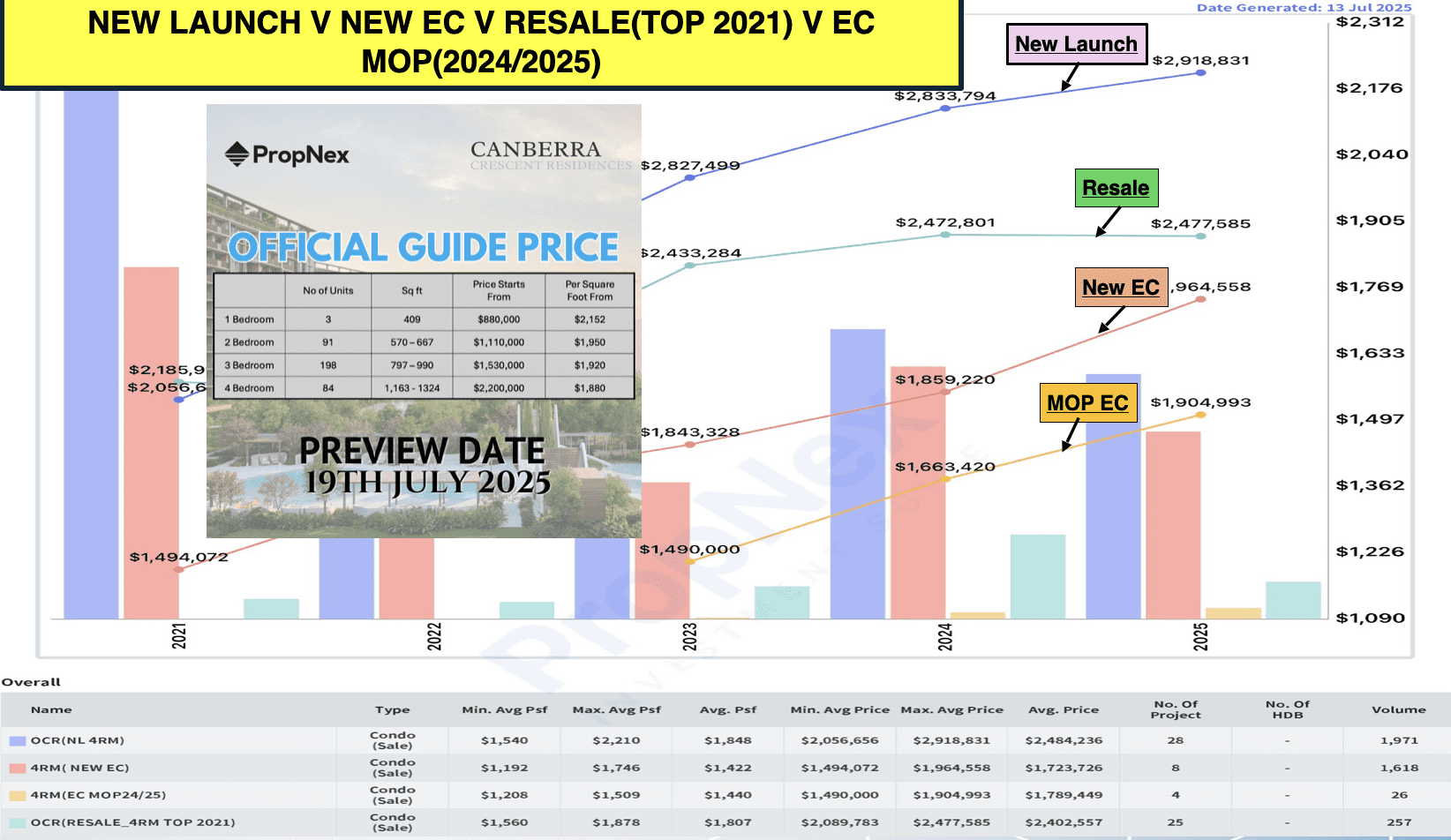

4-Bedroom Prices

Let's take a look at another example, with the 4-bedroom prices at Canberra Crescent Residences versus the OCR market. We can see that a 4-bedroom at Canberra Crescent Residences starts at $2,200,000 , whereas a similar room type new launch is already averaging at $2,918,831. That is literally more than $700,000 for the same room type, isn't that insane?

With prices that competitive, it is almost a brainer when it comes to buying this project. What are the

perks of buying into this development?

- Safe entry price with old price tag

- Private home with prices competitive with ECs

- Northern Transformation on the horizon

- Safe entry price = Good exit strategy

I'm quite sure I am done convincing you just based on the prices alone, the rest of the benefits are bonuses to you.

Curious about how the 3-bedroom prices compare to the market? Watch the Video below to find out now!